35+ Avalanche debt repayment calculator

With the use credit card minimum payments box checked your monthly payment will decrease as your balance is paid down. Ad Take Some of the Stress Out and Get Help Managing Debt.

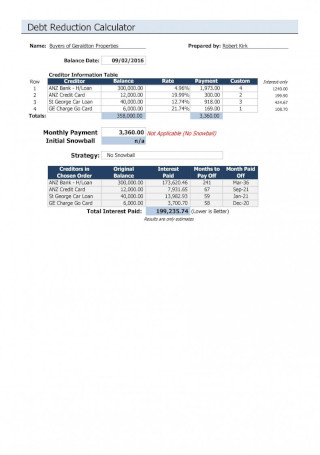

Automatic Debt Snowball Planner Excel Spreadsheet Payoff Debt Etsy Credit Card Payment Tracker Debt Snowball Debt Free Plan

Debt Avalanche Calculator.

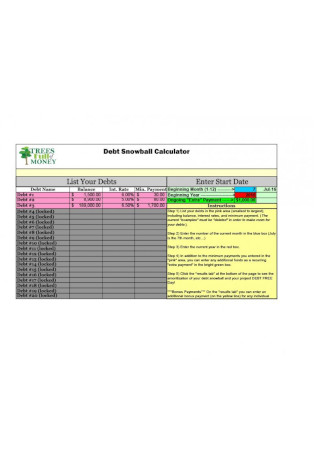

. Welcome to the debt snowballavalanche payoff calculator. This calculator was designed to be easy to use so you only need a few pieces of information to get started. Thanks for using Avalanche Calculator well forever be free and wish you the best.

If you checked the use credit card minimum payments box your monthly payment is calculated as 4 of your current outstanding balance. It will show up on the bottom-right of your screen click it. Additionally it gives users the most cost-efficient payoff sequence with the option of adding extra payments.

Step 1 Add New Debt. If you continue to pay just the minimum on both accounts the calculator shows that it will take you 12709 and 47 months under the snowball method and 12201 and 45 months using the avalanche method to pay off your debts. Find Step-by-Step Assistance to Pay Your Debts.

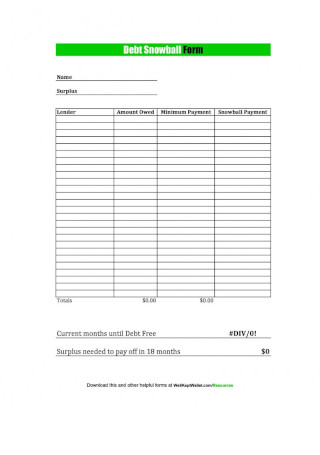

Next enter a monthly dollar amount you could add to your accelerated debt payoff plan. Remember that deciding on a debt repayment strategy is just the first step. When a balance is paid in full apply its monthly payment to the next lowest balance.

Lets get straight to the point here are the two calculators youre here for. The debt snowball calculator offers success in completion. Your total minimum monthly payments equal 275.

And then once it opens at the top of the file select Open with Google Sheets. Ad Reduce Debt With Best BBB Accredited Debt Relief Programs. Click New in the upper left.

Compare Best Offers Now. The purpose of the Avalanche Calculation is to minimize interest paid and pay off high interest accounts first to eliminate future interest being accrued opposed to the Snowball Method - paying off the lowest balances first. Pay off your lowest balances first if there are two with the same balance pay off higher interest rate first.

Deciding which approach to debt repayment is best for you can be difficult. Debt Repayment Calculator. Ad View Editors 1 Pick.

Start by Making a List. Our Debt Repayment Calculator uses the Avalanche Method to help you pay off what you owe. Jan 19 2022 1045am.

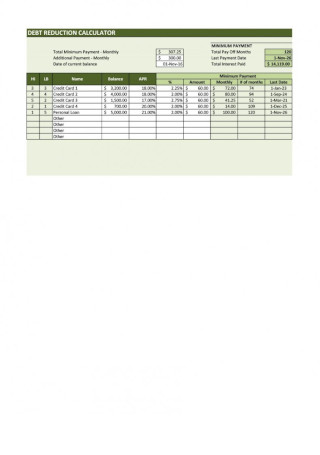

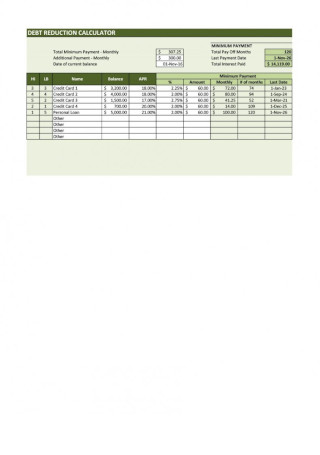

Input your debts interest rates minimum payment and what you can afford to pay each month. 35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word. Ordered from smallest balance to highest balance enter the name current balance interest rate and minimum payment amount for all of your debts up to a maximum of 10 debts.

Lowest balances are paid and motivation is. You can loosely follow our development on our About page each individual development update is summarized. This free tool enables you to enter all of your debts and compare the payoff scenarios between the debt snowball and debt avalanche methods.

Select it then click Open. Our calculator will show you how many months until you are in the clear and how to allocate your repayment to pay as little interest as possible. Lowest Balance First Snowball Total Paid Time.

Youll also be able to see how much principal versus interest youll pay over the lifetime. This can greatly increase the length of time it takes to pay off. Check out our debt avalanche calculator selection for the very best in unique or custom handmade pieces from our shops.

The two most popular debt repayment plans are. Minimum payment Total Paid Time. But ultimately the decision will depend on your goals and priorities.

Add at least one more debt you can add more than the one you want to pay down. The calculator below estimates the amount of time required to pay back one or more debts. Robin Saks Frankel.

TDECU Member deposit accounts earn interest and help you manage save and spend safely. Its important to note that this amount includes the minimum payment amounts. This calculator utilizes the debt avalanche method considered the most cost-efficient payoff strategy from a financial perspective.

Explore the possibilities of student loan forgiveness program with an Equitable 403b. The debt avalanche method is the most cost-effective one since the card with the highest interest rate. Unbiased Expert Reviews Ratings.

The first thing youll want to fill in is the monthly budget amount. Include all your debtsminus mortgage s if you have anywith the account types balances interest rates and minimum amount due each month. It approximates the difference in savings and time by paying debts aggressively vs.

Avalanche Total Paid Time. Another critical strategy is to reduce your interest rates where. Using the Debt Payoff Calculator.

These can include credit cards student loans car loans and any other debts. Find the best debt avalanche excel spreadsheet that you just uploaded and saved. Ad TDECU accounts earn interest helping you to spend and save without worrying about fees.

Our calculator can help you estimate when youll pay off your credit card debt or other debt such as auto loans student loans or personal loans and how much youll need to pay each month based on how much you owe and your interest rate. The budget amount refers to the total amount you can afford to pay towards debt each month. Our Debt Repayment Calculator uses the Avalanche Method to help you pay off what you owe.

Accelerated Debt Repayment Calculator. This calculator compares the different methods of repaying debts. Using the debt avalanche method you make the minimum payments on Card 2 and Card 3 then put your.

Then click File Upload. With either method the top priority is eliminating debt. Plug your numbers into our debt repayment calculator to see how the debt snowball and avalanche methods will work for you.

The Debt Snowball Method Lowest Balance. Plug in your debt details. Our debt avalanche calculator will show you which debt to start repaying first based on your balance with the highest.

Sometimes when you have a lot of debt spread across multiple accounts you wont see the benefits of the avalanche. However if you were to suddenly have say an extra 175 per month to. Determine which debt to start repaying first.

Youll need to include at least two debts to generate a plan. National Debt Relief Receives the Top Ranking in Our Evaluation. Get a Free Consultation.

Ad Our easy-to-use calculator can help see if you might qualify for debt relief.

Free Debt Snowball Excel Worksheet With Chart Debt Snowball Debt Snowball Worksheet Credit Card Debt Payoff

Design Http Design Jackzoo Site In 2022 Saving Money Budget Money Saving Plan Budgeting

Looks Like This Would Work Great If Following Dave Ramsey S Baby Steps Debt Payoff Spreads Credit Card Tracker Paying Off Credit Cards Debt Snowball Worksheet

1

Debt Stacking Excel Spreadsheet Spreadsheet Financial Information Excel Spreadsheets

Debt Stacking Excel Spreadsheet Debt Snowball Calculator Debt Reduction Debt Snowball

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

Debt Payoff Calculator Spreadsheet Debt Snowball Excel Etsy Debt Snowball Debt Snowball Spreadsheet Credit Card Debt Tracker

The Debt Snowball Calculator Avalanche Debt Calculator Uses Two Steps To Pay Off Debt Decide Between Debt Calculator Debt Snowball Calculator Debt Snowball

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

1

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

Best Debt Repayment Method Snowball Or Avalanche Debt Repayment Paying Off Credit Cards Credit Card Payoff Plan

Debt Stacking Excel Spreadsheet Spreadsheet Template Budget Spreadsheet Debt Calculator

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word